As a wellness practitioner in the UK, whether you’re a therapist, coach, holistic healer, or alternative medicine specialist, having the right insurance in place is absolutely essential. It not only protects your practice and reputation but also builds trust with your clients. Yet, understanding how to get your wellness services covered by insurance can feel overwhelming, especially if you’re self-employed or just starting out.

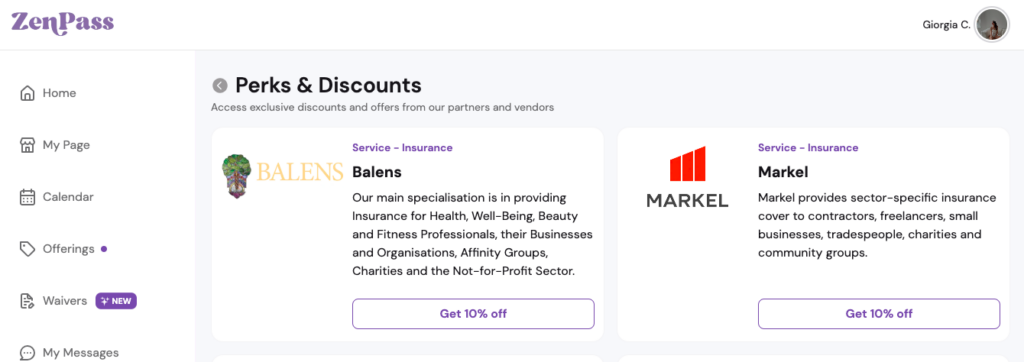

In this guide, we’ll break down everything UK practitioners need to know about securing insurance coverage for wellness services and how joining ZenPass Grow can help you access exclusive discounts with our trusted partners, Markel and Balens Ltd.

Why Insurance is Crucial for Wellness Practitioners

Before we dive into the “how”, let’s briefly explore the “why”. Professional insurance for wellness services is more than just a formality. It:

- Protects against claims: Even with the best intentions, accidents can happen. Professional liability insurance covers claims of negligence, malpractice, or injury.

- Enhances credibility: Clients feel more comfortable knowing their practitioner is insured.

- Meets legal and industry standards: Some local councils, therapy registers, and professional bodies require proof of insurance.

- Covers unexpected scenarios: From client accidents on your premises to cyber threats, insurance helps safeguard your practice’s future.

What Types of Insurance Do Wellness Practitioners Need?

For wellness practitioners in the UK, the most relevant types of insurance include:

- Professional Indemnity Insurance: Covers legal costs and damages if a client claims you’ve made a mistake or given bad advice.

- Public Liability Insurance: Protects you if a member of the public is injured or their property is damaged because of your business.

- Product Liability Insurance: If you sell products, this covers claims arising from their use.

- Employers’ Liability Insurance (if you have staff): A legal requirement in the UK.

- Cyber Insurance: Covers breaches of client data, increasingly important if you offer services online.

- Personal Accident Insurance: Provides financial support if you’re injured and can’t work.

How to Get Your Wellness Services Covered by Insurance

1. Define Your Services Clearly

Insurance providers need a clear understanding of what services you offer. Whether you provide massage therapy, reiki healing, nutrition advice, or personal coaching, each service must be specified.

When applying for insurance:

- List every therapy or treatment you offer.

- Mention if you sell products, such as oils or supplements.

- Highlight any online or remote services, which may require additional cyber cover.

Pro Tip: Transparency is key. If you offer multiple services, choose a provider familiar with multi-disciplinary practices.

2. Choose an Insurance Provider That Understands Wellness

Not all insurers are created equal, especially when it comes to alternative and holistic therapies. You’ll want to partner with insurers who:

- Have experience covering a wide range of wellness modalities.

- Offer flexible policies that grow with your business.

- Provide access to legal advice and support when needed.

Two highly reputable names for UK practitioners are Markel and Balens Ltd, both trusted partners of ZenPass Grow, view ZenPass plans and discover Grow Plan benefits.

3. Check Professional Body Requirements

If you are a member of a professional organisation (such as the Federation of Holistic Therapists or the Complementary Medical Association), they often have insurance requirements you must meet.

Membership in these bodies can also entitle you to better insurance rates or bundled packages. Make sure your chosen policy aligns with your association’s standards.

4. Understand Policy Inclusions and Exclusions

Before committing, carefully review the fine print:

- What’s covered? (e.g., specific therapies, products sold, locations)

- What’s excluded? (e.g., high-risk treatments, certain types of advice)

- Are there limits to the cover? (e.g., maximum indemnity amounts)

- What are the excess charges? (the amount you pay if you make a claim)

Pro Tip: It’s always better to ask questions now than face surprises later!

5. Keep Certifications and Training Up to Date

Insurers may require proof of relevant qualifications for the therapies you offer. Keeping your certifications current not only ensures compliance but can also support your claim if a dispute arises.

In some cases, higher or specialised qualifications can even help you secure lower premiums.

6. Combine Your Coverage for Savings

Instead of purchasing separate policies, look for bundled packages that combine professional indemnity, public liability, and product liability under one plan.

Through ZenPass Grow, practitioners can access comprehensive insurance bundles at discounted rates, making it more affordable to protect every aspect of their business.

Common Misconceptions About Wellness Insurance (And How to Overcome Them)

When it comes to getting wellness services insured in the UK, there are quite a few persistent myths that can confuse practitioners. Let’s clear up the biggest misconceptions:

“My therapy isn’t recognised by mainstream insurers, so I can’t get cover.”

Reality: Specialist insurers like Markel and Balens Ltd specifically cater to wellness and holistic practitioners, offering tailored policies for a vast range of services.

Solution: Choose specialist providers experienced in complementary health and subscribe to ZenPass Grow to access our vetted insurance partners.

“I only work remotely/online — I don’t need insurance.”

Reality: Providing professional advice online still carries risk. Cyber threats and client disputes can happen without face-to-face interaction.

Solution: Ensure your insurance covers remote services and includes cyber liability protection.

“Insurance is too expensive, especially when I’m just starting out.”

Reality: Insurance is an affordable investment compared to the cost of legal disputes or claims. ZenPass Grow members enjoy discounted rates, making protection accessible from day one.

Solution: Use ZenPass Grow’s partner discounts and start with essential coverage, expanding as your business grows, get support with insurance and admin as a new practitioner.

“My membership with a professional body automatically covers me.”

Reality: Most memberships give access to insurance schemes but do not automatically insure you.

Solution: Always check and purchase the appropriate insurance independently if necessary.

“Once I’m insured, I don’t need to think about it again.”

Reality: Your business evolves. Offering new therapies or products without updating your policy can leave you exposed.

Solution: Regularly review and update your insurance whenever your services change.

By addressing these misconceptions early, you’ll not only secure the right cover but also strengthen your professional standing. A well-insured practice shows clients that you are serious, credible, and committed to providing high-quality, responsible care.

How ZenPass Grow Helps You Get Covered and Save Money

When you subscribe to ZenPass Grow, you gain access to exclusive insurance discounts with our carefully selected partners:

- Markel: Offering tailored insurance solutions with flexible payment options.

- Balens Ltd: Specialising in holistic, complementary, and alternative therapies, with decades of experience protecting wellness practitioners.

As a ZenPass Grow member, you’ll benefit from:

- Discounted insurance rates.

- Access to expert advice and support.

- Specialised packages designed for multi-disciplinary practitioners.

- Seamless, stress-free insurance sign-up directly through your dashboard.

Final Thoughts: Protect Your Passion, Protect Your Practice

Having the right insurance in place allows you to focus on what you love most, helping your clients thrive — without worrying about the unexpected. In today’s world, being fully insured isn’t just good practice; it’s vital for building a resilient and reputable wellness business.

Explore how ZenPass supports wellness businesses across the UK.

Ready to protect your wellness business and unlock exclusive insurance savings?

Subscribe to ZenPass Grow today and get covered with confidence through our trusted partners Markel and Balens Ltd!

Your practice deserves it, and your peace of mind does too.

Need a hand getting started? Explore our Help Centre for step-by-step guides, FAQs, and tips to make the most of ZenPass.

Visit the Help Centre now and find the answers you need.

Leave a Reply